In today’s digital age, online payment processors are essential for e-commerce success. They help businesses accept payments quickly and securely.

Finding the right payment processor can make a huge difference. It affects customer satisfaction, fees, and even sales. With so many options available, choosing the best one can be overwhelming. This blog post will guide you through the top online payment processors for e-commerce.

We’ll highlight their features, benefits, and drawbacks. By the end, you’ll have a clear idea of which payment processor fits your needs. Dive in to discover the best solutions for your online store.

Credit: www.jotform.com

Introduction To Online Payment Processors

Online payment processors simplify transactions for e-commerce businesses. Some of the best options include PayPal, Stripe, and Square. These platforms offer secure, easy-to-use solutions for accepting payments online.

Online payment processors are essential for e-commerce businesses. These services allow businesses to accept payments from customers safely. With the rise of online shopping, choosing the right payment processor is crucial. It impacts customer trust and sales.Importance For E-commerce

Payment processors ensure secure transactions. They protect both the buyer and the seller. They also help prevent fraud. A smooth payment process enhances customer experience. It encourages repeat purchases. Businesses can accept various payment methods. This flexibility attracts more customers.Trends In 2025

Payment methods are evolving. Digital wallets are becoming popular. Contactless payments are on the rise. Mobile payments are growing. Customers value speed and convenience. Integrating AI can improve payment security. Blockchain technology may offer more transparency. Keeping up with these trends is vital. It can give businesses a competitive edge. “`Key Features To Look For

When it comes to choosing the best online payment processor for your e-commerce business, there are several key features you should consider. The right payment processor can make a significant difference in how smoothly your transactions go, impacting both your sales and customer satisfaction. Let’s dive into some of the most important features to look for.

Security Measures

Security is a top priority when handling online payments. Your customers need to feel safe when entering their payment details on your site. Here are some security features to look for:

- Encryption: This ensures that sensitive data is protected during transmission.

- Fraud Detection: Advanced systems can help detect and prevent fraudulent transactions.

- PCI Compliance: Make sure the processor complies with Payment Card Industry Data Security Standards (PCI DSS).

For instance, many processors use tokenization, which replaces sensitive card details with a unique identifier, adding an extra layer of security. Imagine the peace of mind knowing your customer’s data is shielded from prying eyes!

Integration Ease

Another critical feature is how easily the payment processor integrates with your e-commerce platform. Here are some considerations:

- API Documentation: Clear and comprehensive API documentation can make integration smoother.

- Plugin Availability: Does the processor offer plugins for your e-commerce platform (e.g., WooCommerce, Shopify)?

- Developer Support: Access to dedicated support can be invaluable during the integration process.

For example, if you’re using WooCommerce, a payment processor with a dedicated WooCommerce plugin can save you a ton of time and headaches. Trust me, you’ll thank yourself later when everything runs like a well-oiled machine.

Choosing the right online payment processor involves a bit of homework, but the payoff is worth it. Prioritize security and ease of integration, and you’ll be well on your way to a seamless payment experience for both you and your customers.

Top Payment Processors

Choosing the right online payment processor is crucial for any e-commerce business. A good payment processor ensures smooth transactions and increases customer trust. Here, we explore some of the top payment processors that can help your business thrive.

Paypal

PayPal is one of the most popular payment processors worldwide. It supports multiple currencies and is trusted by millions. Setting up a PayPal account is easy, making it accessible for small businesses. It also offers features like buyer protection and fraud prevention. PayPal integrates seamlessly with most e-commerce platforms. This makes it a convenient option for online stores.

Stripe

Stripe is known for its developer-friendly interface and powerful tools. It supports a wide range of payment methods, including credit cards, debit cards, and digital wallets. Stripe offers customizable checkouts, which enhance user experience. It also provides detailed analytics, helping businesses track their performance. Stripe is a great choice for businesses looking for flexibility and scalability.

Emerging Payment Solutions

In the ever-evolving world of e-commerce, staying ahead of the curve is crucial. One of the key areas where innovation is happening rapidly is online payment processing. Gone are the days when credit cards and bank transfers were the only options. Now, there are numerous emerging payment solutions that are not only more efficient but also cater to the diverse needs of consumers. Let’s dive into some of these exciting new payment methods.

Cryptocurrency Options

Cryptocurrencies, like Bitcoin and Ethereum, are no longer just buzzwords. They have become legitimate payment options for many online businesses. What makes cryptocurrencies so appealing?

- Decentralization: Unlike traditional currencies, cryptocurrencies are not controlled by any central authority. This means lower transaction fees and faster processing times.

- Security: Cryptocurrency transactions are secured by cryptography, making them incredibly difficult to tamper with.

- Global Reach: Cryptocurrencies can be used by anyone, anywhere in the world, without the need for currency exchange.

For instance, a friend of mine runs a small online store selling handmade jewelry. She recently started accepting Bitcoin payments and saw a 20% increase in sales from international customers. It’s a game-changer!

Mobile Wallets

Mobile wallets, such as Apple Pay, Google Wallet, and Samsung Pay, are revolutionizing the way we pay online. These wallets allow users to store their payment information securely on their smartphones, making transactions quick and easy.

- Convenience: With just a few taps on your phone, you can complete a purchase. No need to fumble around for your credit card or remember a long string of numbers.

- Security: Mobile wallets use advanced encryption and biometric authentication (like fingerprint or facial recognition) to protect your information.

- Loyalty Integration: Many mobile wallets integrate with loyalty programs, allowing users to earn and redeem rewards effortlessly.

Imagine you’re out shopping and realize you forgot your wallet at home. No problem! Just use your phone to pay. It’s that simple.

As e-commerce continues to grow, adopting these emerging payment solutions can give your business a competitive edge. Whether it’s embracing the future with cryptocurrencies or offering the convenience of mobile wallets, these options are worth considering.

Comparing Fees And Costs

When it comes to running an e-commerce business, choosing the right online payment processor can make a huge difference in your bottom line. Not all payment processors are created equal, and the fees and costs associated with them can vary significantly. In this section, we’ll dive into the nitty-gritty of comparing fees and costs to help you make an informed decision.

Transaction Fees

Transaction fees are the charges that payment processors impose every time a customer makes a purchase. These fees can add up quickly, especially if you have a high volume of sales. Let’s take a closer look at some popular payment processors and their transaction fees:

| Payment Processor | Transaction Fee |

|---|---|

| PayPal | 2.9% + $0.30 per transaction |

| Stripe | 2.9% + $0.30 per transaction |

| Square | 2.6% + $0.10 per transaction |

As you can see, while the percentage fee is generally around 2.9%, the fixed fee per transaction can vary. This might not seem like a big deal, but if you have thousands of transactions, it can really impact your profits. For example, if you sell low-cost items, a higher fixed fee could eat into your margins.

Monthly Charges

In addition to transaction fees, some payment processors also charge monthly fees. These fees can cover things like access to advanced features, customer support, and more. Here’s a quick breakdown of the monthly charges for some top processors:

- PayPal: No monthly fee for the standard plan, but $30/month for PayPal Payments Pro.

- Stripe: No monthly fee, but additional charges for advanced features.

- Square: No monthly fee for the basic plan, but charges for premium services.

Not having a monthly fee can be beneficial if you’re just starting out or if your sales volume is inconsistent. However, paying a monthly fee could be worth it if it gives you access to features that can help your business grow, like advanced analytics or better customer support.

In conclusion, comparing fees and costs is crucial when selecting an online payment processor for your e-commerce store. Take the time to understand both the transaction fees and any potential monthly charges. Remember, the cheapest option isn’t always the best; consider the value and features you get for your money. Happy selling!

Credit: motuscc.com

User Experience And Support

Choosing the best online payment processor for e-commerce requires more than just low fees. User experience and support play crucial roles in ensuring smooth transactions. This section will explore these aspects to help you make an informed decision.

Customer Service

Responsive customer service is vital for any e-commerce platform. Look for payment processors that offer 24/7 support. Quick issue resolution can save you time and money. Some providers offer live chat, phone support, and email assistance. Check if they have a dedicated help center. This can provide useful resources and FAQs.

User Interface

A user-friendly interface makes managing payments easier. The dashboard should be intuitive. It should show transaction details clearly. A good interface reduces the learning curve. This helps you focus more on your business. Test the interface before committing. Make sure it meets your needs.

Regional Considerations

Choosing the right online payment processor is crucial for e-commerce success. One important factor to consider is regional differences. Different regions have unique needs and preferences. Understanding these can help you select the best processor for your business.

Global Availability

Not all payment processors operate worldwide. Some excel in specific regions. Before choosing, check if the processor supports your target markets. Look at the countries where your customers are located. Ensure the processor has a strong presence there. This can help avoid transaction issues and improve customer trust.

Local Payment Methods

Customers in different regions prefer different payment methods. In some countries, credit cards are popular. In others, mobile payments dominate. Choose a processor that supports local payment methods. This can increase conversion rates. It makes the payment process easier for your customers.

Research common payment methods in your target markets. Select a processor that integrates with these options. This can help you provide a seamless shopping experience. It also shows that you understand your customers’ needs. Happy customers are more likely to return.

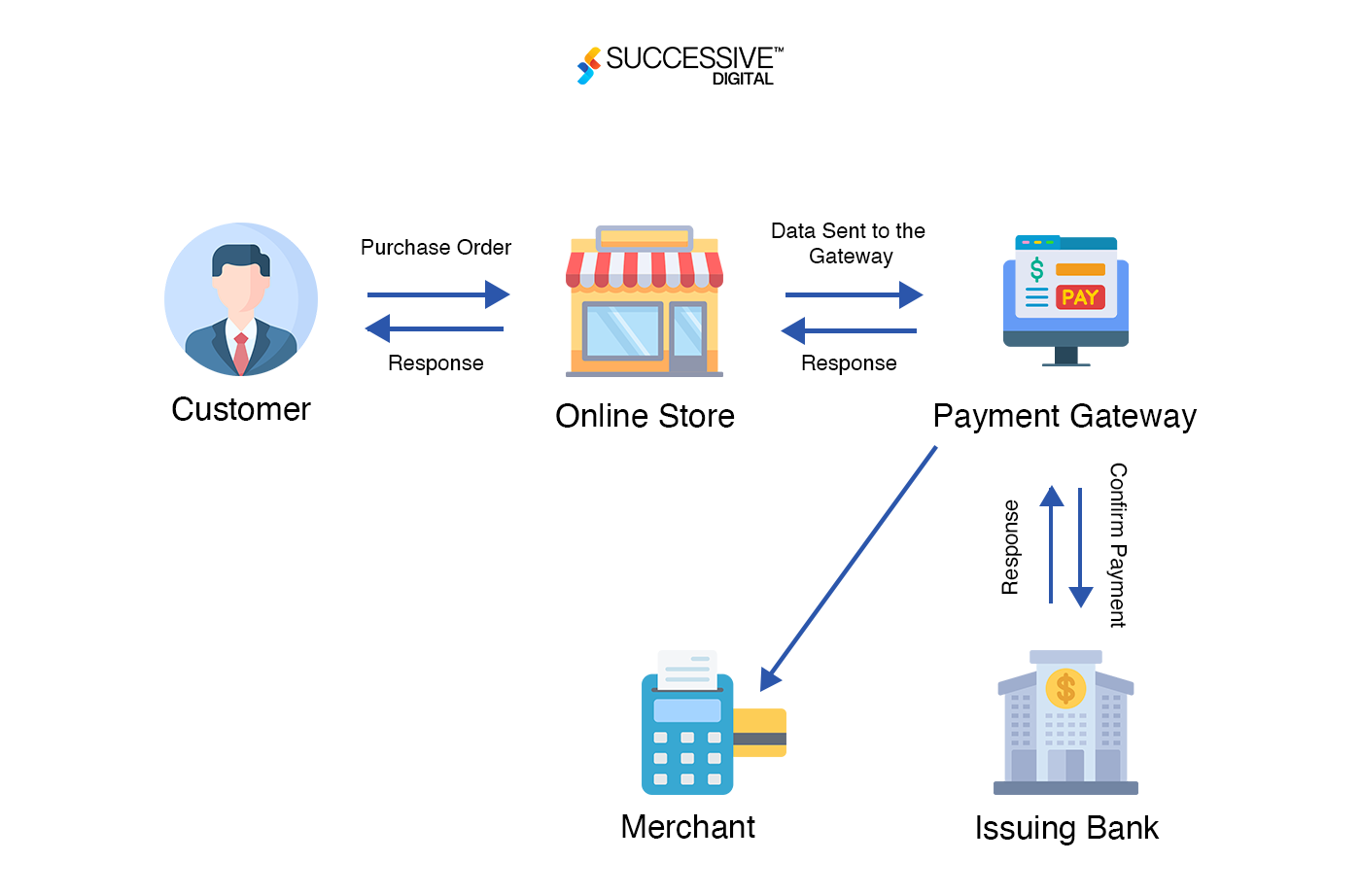

Credit: successive.tech

Future Predictions

As e-commerce continues to evolve, it’s crucial to stay ahead of the game. The landscape of online payment processors is changing rapidly, thanks to groundbreaking technologies. So, what does the future hold? Let’s dive into some predictions that are set to transform the way we handle online transactions.

Ai Integration

Artificial Intelligence (AI) is no longer just a buzzword; it’s becoming a cornerstone in the world of e-commerce. Imagine a payment processor that learns from every transaction. AI can help in:

- Fraud Detection: AI can analyze transaction patterns and flag suspicious activities in real-time.

- Personalized Experiences: Tailored recommendations based on customer behavior enhance user satisfaction.

- Efficiency: Automated processes reduce human error and speed up transactions.

Picture this: you’re running an online store, and your payment processor suggests the best payment options for each customer. It’s like having a smart assistant who knows your business inside out.

Blockchain Impact

Blockchain technology is more than just Bitcoin. It’s a game-changer for online payments. Here’s how:

- Transparency: Every transaction is recorded on a public ledger, making it almost impossible to alter or fake.

- Security: Decentralized networks reduce the risk of hacks.

- Lower Fees: Cutting out middlemen can significantly reduce transaction costs.

Consider this: you’re making a big purchase online. With blockchain, you get a secure and transparent transaction, minus the hefty fees. It’s not just a win-win; it’s the future of e-commerce.

In conclusion, as we look ahead, the integration of AI and blockchain technologies in online payment processors promises a more secure, efficient, and personalized shopping experience. Whether you’re a small business owner or a seasoned e-commerce giant, staying updated with these trends will help you stay competitive in the ever-evolving digital marketplace.

Frequently Asked Questions

What Is The Best Payment Processor For Ecommerce?

The best payment processor for eCommerce is Stripe. It offers easy integration, robust security, and supports multiple currencies. Its user-friendly interface and advanced features make it ideal for online businesses.

Which Payment Method Is Best For E-commerce?

Credit and debit cards are the best payment methods for e-commerce. They offer convenience, security, and are widely accepted.

What Online Payment System Is Best For Small Businesses?

PayPal and Stripe are popular online payment systems for small businesses. They offer easy integration, low fees, and reliable security.

Who Is The Leader In Payment Processing?

The leader in payment processing is Visa. They dominate the market with their extensive network and innovative solutions.

Conclusion

Choosing the right online payment processor is crucial for your e-commerce success. It ensures smooth transactions and builds customer trust. Evaluate factors like fees, security, and ease of use. Different options suit different business needs. Make sure to pick one that aligns with your goals.

With the right choice, you can enhance customer satisfaction and drive more sales. So, take your time and make an informed decision. Your e-commerce business will benefit greatly from it. Happy selling!