Setting up recurring payments for subscriptions is simple and efficient. It ensures smooth transactions and consistent revenue.

Recurring payments automate the billing process for subscription services. This is essential for businesses that rely on regular income, such as streaming platforms, fitness memberships, or software services. By setting up recurring payments, you save time and reduce the risk of missed payments.

Customers enjoy the convenience of not having to remember due dates, and businesses benefit from steady cash flow. In this guide, you’ll learn the steps to set up recurring payments, making the process seamless for both you and your customers. Whether you’re a small business owner or managing a large company, this information will help streamline your payment system.

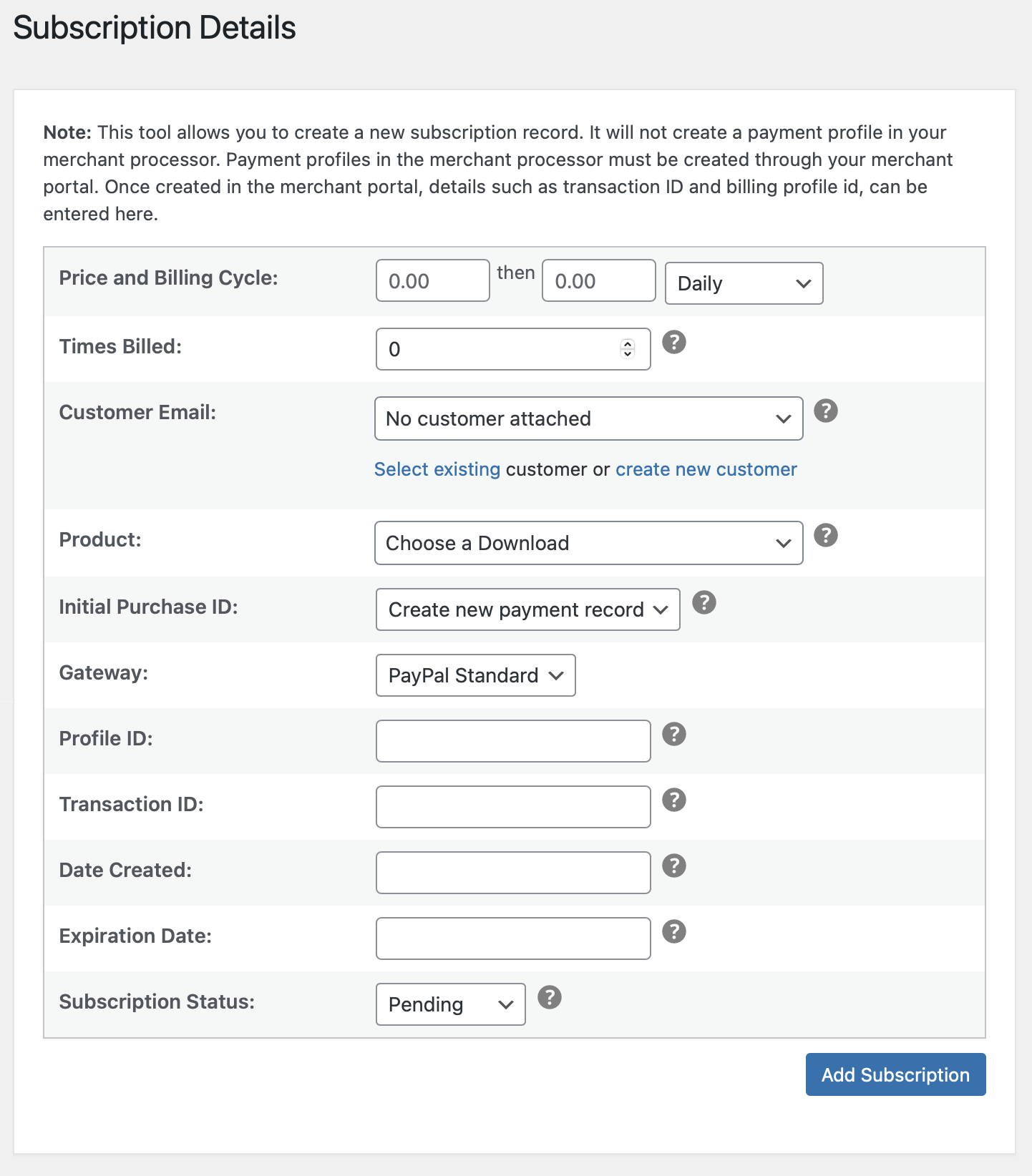

Credit: easydigitaldownloads.com

Introduction To Recurring Payments

Setting up recurring payments for subscriptions can seem like a daunting task, but it doesn’t have to be. Once you understand the basics, it becomes much easier to manage. Recurring payments are a great way to ensure that your customers are consistently billed for the services or products they subscribe to, without needing to manually process each transaction. In this section, we will explore what recurring payments are and the benefits they offer.

What Are Recurring Payments?

Recurring payments, also known as subscription payments, are automatic payments that are made on a regular basis. These can be weekly, monthly, quarterly, or annually, depending on the subscription model you choose. Once set up, these payments are processed automatically, which saves time and reduces the risk of missed payments.

Benefits Of Recurring Payments

There are several advantages to using recurring payments for your subscriptions:

- Consistency: Recurring payments ensure that you receive payments on a regular basis, providing a steady cash flow.

- Convenience: Customers don’t have to remember to make manual payments, which can improve their overall experience.

- Reduction in Late Payments: Automated payments reduce the likelihood of late or missed payments.

- Better Customer Retention: Simplifying the payment process can lead to higher customer satisfaction and loyalty.

Imagine never having to chase down a payment again. Doesn’t that sound wonderful? Recurring payments can make that dream a reality.

In conclusion, setting up recurring payments for your subscriptions is a smart move for both you and your customers. It provides reliability, ease, and peace of mind. So, why wait? Start exploring your options today and take the hassle out of managing payments.

Choosing The Right Payment Processor

Setting up recurring payments for subscriptions is no small feat. One of the most crucial steps in this process is choosing the right payment processor. The payment processor you select can make or break your subscription service. It affects everything from transaction fees to the user experience. So, how do you pick the best one? Let’s dive in!

Popular Payment Processors

When it comes to payment processors, there are several big names you might have heard of. Here’s a quick look at some popular options:

- PayPal: A household name with a strong reputation for security.

- Stripe: Known for its developer-friendly API and customization options.

- Square: Great for small businesses, with a simple setup process.

- Authorize.net: A reliable choice with extensive features.

Each of these has its pros and cons, but they all offer solid platforms for managing recurring payments.

Key Features To Consider

Choosing the right payment processor isn’t just about picking a popular name. You need to consider specific features that will make your life easier and keep your customers happy. Here are some key features to look for:

| Feature | Description |

|---|---|

| Security | Ensure the payment processor is PCI-DSS compliant to protect customer data. |

| Ease of Use | A simple and intuitive interface saves time and reduces errors. |

| Integration | Check if it integrates well with your website or app. |

| Customer Support | 24/7 support can be a lifesaver in resolving issues quickly. |

Additionally, consider the following:

- Transaction Fees: Compare fees to ensure they align with your budget.

- Global Reach: If you have international customers, make sure the processor supports multiple currencies.

- Recurring Billing Features: Look for options like automated billing, retry logic, and subscription management.

Remember, the right payment processor will grow with your business. So, think long-term and choose wisely!

Setting Up Your Payment Gateway

Setting up a payment gateway is crucial for managing recurring payments. It ensures smooth transactions and keeps your subscription service running seamlessly. In this section, we will guide you through creating an account and configuring payment settings.

Creating An Account

First, choose a payment gateway provider. Some popular options include PayPal, Stripe, and Square. Visit the provider’s website to start the sign-up process. Fill in your details, such as name, email, and business information. Verify your email address to activate the account.

After verification, log in to your new account. Navigate to the dashboard, where you can access various features. Ensure you complete any additional verification steps required by the provider. This might include linking your bank account or providing identification documents.

Configuring Payment Settings

Once your account is set up, configure the payment settings. Go to the settings or payment section in your dashboard. Here, you can set your preferred currency, payment methods, and billing cycles.

Enable recurring billing options. Specify the frequency of payments, such as monthly, quarterly, or annually. Set up notifications for both you and your customers. These can include payment confirmations and reminders for upcoming charges.

Integrate the payment gateway with your website or application. Most providers offer plugins or APIs for easy integration. Follow the instructions provided to complete the setup process.

Test the system by making a small transaction. Ensure everything works correctly. Check if the payments are processed and recorded properly. This helps in avoiding any issues when your customers make their payments.

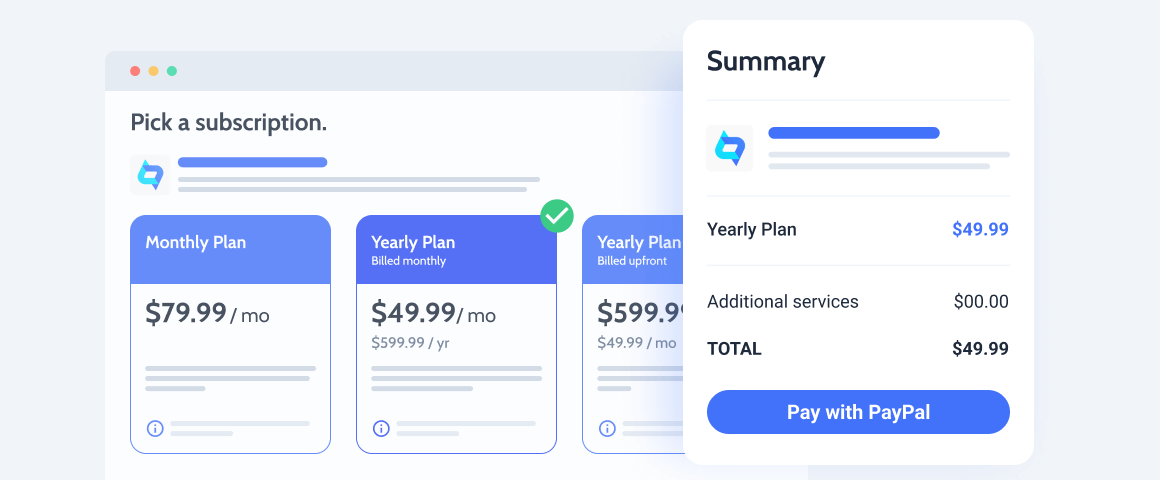

Credit: jetformbuilder.com

Integrating With Your Website

Setting up recurring payments on your website can boost your business. It simplifies billing and ensures a steady income stream. To get started, you need to integrate a payment system with your website. This section will guide you through the essential steps.

Using Apis

APIs connect your website to payment gateways. They allow secure transactions. Most payment providers offer APIs. You can find them in their developer section. Follow their documentation closely. It usually includes code snippets and examples.

Integrate the API into your website’s backend. Ensure you test the integration. Testing helps identify any issues before going live. Use sandbox environments provided by payment gateways. This will help simulate transactions without real money.

Embedding Payment Forms

Embedding payment forms is another option. It involves adding pre-built forms to your website. These forms handle all payment processing. Payment providers offer easy-to-use form builders. Customize these forms to match your website’s design.

Copy and paste the form’s embed code into your website. Place it in a secure area, like a checkout page. Ensure the form is user-friendly. A well-designed form improves user experience and reduces cart abandonment.

Test the embedded form thoroughly. Make sure it works on all devices. Responsive design is crucial for mobile users. Double-check that all fields and buttons function correctly.

Creating Subscription Plans

Setting up recurring payments for subscriptions can seem like a daunting task, but it doesn’t have to be. One of the key steps in this process is creating subscription plans. This involves defining how much you will charge and how often. A well-structured subscription plan can keep your customers happy and your revenue steady. Let’s dive into the details of creating subscription plans, starting with defining pricing tiers and setting billing cycles.

Defining Pricing Tiers

When creating subscription plans, the first step is to define pricing tiers. Pricing tiers help cater to different customer needs and budgets. Think about the variety of services or features you offer and how you can package them into different plans.

- Basic Plan: This could be a starter plan with limited features at a lower price. Perfect for new users.

- Standard Plan: A mid-tier plan with more features. This is usually the most popular choice.

- Premium Plan: An all-inclusive plan with all the bells and whistles. Ideal for power users.

For example, if you are offering a software service, your basic plan might include core functionalities, the standard plan might add some advanced features, and the premium plan might offer unlimited access and priority support.

Setting Billing Cycles

Once you have your pricing tiers, the next step is setting billing cycles. Billing cycles determine how often your customers will be charged. The most common cycles are monthly and annually, but you can get creative based on your business model.

- Monthly Billing: Charges customers every month. This is a good option for those who prefer smaller, more frequent payments.

- Annual Billing: Charges customers once a year, often at a discounted rate. This can help with customer retention.

- Quarterly Billing: Charges customers every three months. This is a middle ground between monthly and annual billing.

For instance, if you are running an online course platform, you might offer a monthly plan at $20/month, a quarterly plan at $50/quarter, and an annual plan at $180/year. Providing multiple billing cycle options can appeal to a wider audience.

In conclusion, creating subscription plans is all about understanding your audience and offering them choices that fit their needs and budget. By defining pricing tiers and setting appropriate billing cycles, you can create a smooth and customer-friendly subscription experience.

Testing The Payment System

Before you go live with your subscription service, it’s crucial to test your payment system. This step ensures that everything works smoothly for your customers. Imagine the frustration if a user tries to pay, and it doesn’t work. Testing helps you avoid these pitfalls and builds trust with your subscribers.

Running Test Transactions

Running test transactions is like a dress rehearsal for your payment system. It’s where you check if everything is ready for the big show. Here’s a simple way to go about it:

- Set Up a Test Environment: Most payment gateways offer a sandbox environment. This is a safe place where you can run tests without using real money.

- Create Test Accounts: You can create dummy accounts with fake data. This helps you simulate real transactions.

- Run Different Scenarios: Try various payment scenarios. For example:

- Successful payments

- Failed payments due to insufficient funds

- Expired cards

By running these tests, you can catch any issues before your customers do. It’s like checking your homework before handing it in!

Ensuring Security

Security is paramount when dealing with payments. You wouldn’t want your customers’ sensitive information to be at risk. Here are some steps to ensure security:

| Step | Description |

|---|---|

| Use SSL Certificates | SSL certificates encrypt the data between your website and your customers. This makes it harder for hackers to steal information. |

| PCI Compliance | Ensure your payment system follows the Payment Card Industry Data Security Standard (PCI DSS). This is a set of guidelines to keep payment information safe. |

| Regular Security Audits | Conduct regular security checks. This helps you catch vulnerabilities before they become a problem. |

Remember, a secure payment system not only protects you but also builds trust with your customers. They are more likely to stick around if they know their data is safe with you.

In conclusion, testing your payment system ensures a seamless experience for your subscribers. It helps you catch issues early and ensures that payments are secure. So, roll up your sleeves and get testing!

Managing Customer Subscriptions

Managing customer subscriptions is crucial for any business offering recurring payments. It ensures customer satisfaction and smooth operations. Properly handling subscriptions can improve retention rates and reduce churn. Let’s explore some essential aspects of managing customer subscriptions.

Handling Cancellations

Cancellations are a part of any subscription business. Make the process easy for your customers. Provide a clear cancellation policy. Include a simple step-by-step guide on your website. This transparency builds trust and reduces frustration.

Offer options to pause instead of canceling. This can retain customers who might return later. Collect feedback during the cancellation process. This helps you understand why customers leave and what you can improve.

Processing Upgrades And Downgrades

Customers often need to change their subscription plans. Make this process as smooth as possible. Provide an easy way for customers to upgrade or downgrade their plans. This flexibility can improve customer satisfaction.

Clearly explain the benefits of each plan. This helps customers make informed decisions. Automate the process to minimize errors and delays. Ensure customers receive immediate confirmation of their changes.

Communicate any changes in billing promptly. This avoids confusion and maintains trust. Regularly review and update your plans. This keeps them competitive and relevant to your customers’ needs.

Monitoring And Reporting

Monitoring and reporting are critical components of managing recurring payments for subscriptions. They ensure you can track all transactions and keep your financial records accurate. Effective monitoring helps identify issues and maintain a smooth payment process. Detailed reports provide insights into your business’s financial health.

Tracking Payment Success

Track the success of each payment to avoid missed revenue. Use automated systems to monitor each transaction’s status. This helps in identifying any failed payments quickly. Always check if payments are processed on time. Keep an eye on recurring payment cycles to ensure they run smoothly. Regular tracking helps in maintaining customer trust.

Generating Financial Reports

Generate financial reports to analyze your subscription business. These reports show the performance of your recurring payments. They provide insights into revenue trends and potential issues. Use these reports to make informed decisions. Financial reports also help in planning for growth. Regular reporting ensures you stay on top of your financial health.

Troubleshooting Common Issues

Recurring payments for subscriptions can simplify billing. But sometimes issues arise. Troubleshooting these common issues ensures smooth transactions and happy customers. Below, we discuss key areas to focus on.

Failed Transactions

Failed transactions can frustrate both businesses and customers. Common reasons include expired credit cards, insufficient funds, or incorrect billing information. Regularly update your payment gateway. Ensure customer payment details are current. Use automated reminders for expiring cards. This minimizes failed transactions.

Customer Support Best Practices

Effective customer support resolves issues quickly. Train support teams to handle payment problems. Offer multiple contact options like email, phone, and chat. Respond promptly to customer inquiries. Clear communication builds trust. Provide step-by-step guides for common issues. This empowers customers to resolve minor problems themselves.

Credit: recurly.com

Frequently Asked Questions

What Is The Easiest Way To Set Up Recurring Payments?

The easiest way to set up recurring payments is by using online payment platforms like PayPal or Stripe. These platforms offer simple, user-friendly interfaces for managing subscriptions and automatic billing. You can integrate them with your website or app quickly.

What Is The Difference Between Recurring Payments And Subscriptions?

Recurring payments are automatic transactions occurring at regular intervals. Subscriptions grant access to products or services over time, often involving recurring payments.

How Can I Accept Recurring Payments?

To accept recurring payments, use a payment gateway like Stripe or PayPal. Set up subscription billing. Ensure your website supports secure transactions. Integrate with accounting software for tracking.

How To Set Up Automatic Payments Between Accounts?

Log in to your bank account. Navigate to the automatic payments section. Select the accounts, set the amount and schedule. Save your settings.

Conclusion

Setting up recurring payments for subscriptions simplifies your billing process. It ensures timely payments, reducing missed dues. Easy to manage, it saves time and effort. Recurring payments improve customer satisfaction and loyalty. Most importantly, they provide a steady revenue stream.

This method also helps in budgeting and forecasting. Start today and streamline your subscription service. Make payments hassle-free for your customers. Simplify your business operations with recurring payments. Your business will benefit greatly from this efficient system.