In the world of e-commerce, secure online payment methods are crucial. They ensure customer trust and protect financial data.

Online shopping has become a norm in our lives. As more people buy goods and services online, the need for secure payment options grows. Cyber threats are on the rise, making it vital to use safe payment methods. This article will guide you through the best secure online payment methods for e-commerce.

Understanding these options will help you protect your business and customers. So, let’s dive into how you can make your online transactions safer.

Introduction To Secure Online Payments

Online payments are essential for e-commerce. They enable customers to purchase goods and services quickly. But, the security of these payments is crucial. This blog post introduces secure online payment methods. It explains their importance and their impact on e-commerce.

Importance Of Security

Security in online payments protects customers’ sensitive information. It includes credit card numbers and personal details. Safe transactions build trust between customers and e-commerce businesses. Without security, customers may face fraud or identity theft. This can lead to serious financial losses.

Impact On E-commerce

Secure payment methods attract more customers to online stores. They feel confident that their information is safe. This can increase sales and repeat purchases. On the other hand, poor security can lead to distrust. Customers may avoid a website that seems unsafe. This can result in lost revenue for businesses.

In summary, secure online payments are vital for the success of e-commerce. They ensure customer trust and protect sensitive information. This leads to a better shopping experience and higher sales.

Credit: www.payretailers.com

Common Online Payment Methods

Secure online payment methods are vital for e-commerce. They build trust and ensure smooth transactions. This section explores common online payment methods that businesses can offer to their customers.

Credit And Debit Cards

Credit and debit cards are the most popular online payment methods. They offer convenience and are widely accepted. Customers simply enter their card details to make a payment. The transaction is processed quickly and securely. Many e-commerce platforms support credit and debit card payments. This method includes fraud protection features. It is a trusted choice for many shoppers.

Bank Transfers

Bank transfers are another secure online payment option. They are suitable for larger transactions. Customers transfer money directly from their bank account to the merchant’s account. This method is secure and reliable. It may take longer to process compared to card payments. Some customers prefer this method for its simplicity. Many e-commerce businesses accept bank transfers for added flexibility.

Digital Wallets

Digital wallets have become a popular choice for online payments. They offer a fast, secure, and convenient way to pay for goods and services. With a digital wallet, you can store your payment information in one place. This means you don’t need to enter your card details every time you make a purchase. Let’s explore some popular digital wallets and their benefits.

Popular Digital Wallets

Several digital wallets are widely used today. PayPal is one of the most popular options. It allows users to link their bank accounts and credit cards. Apple Pay is another favorite, especially among iPhone users. It offers a seamless payment experience. Google Wallet is also a strong contender. It works well with Android devices and integrates with Google services. Samsung Pay is a good choice for Samsung users. It supports both NFC and MST payments.

Benefits Of Using Digital Wallets

Digital wallets offer many benefits. They provide enhanced security. Your card details are not shared with merchants. This reduces the risk of fraud. Digital wallets are also very convenient. You can make payments with just a few taps. This saves time and reduces the hassle of entering card details. Many digital wallets also offer rewards and cashback. This adds extra value to your purchases. Lastly, they support contactless payments. This is especially useful in today’s world where hygiene is a concern.

Credit: cybersecuritynews.com

Cryptocurrency Payments

In the world of e-commerce, secure online payment methods are crucial. One such innovative method is cryptocurrency payments. Cryptocurrencies like Bitcoin and Ethereum are becoming more popular. They offer a secure and fast way to make transactions online. This section will dive into how cryptocurrency payments work and their advantages for e-commerce.

How Cryptocurrency Works

Understanding cryptocurrency might sound tricky, but let’s break it down. Cryptocurrencies are digital or virtual currencies. They use cryptography for security. Unlike traditional money, they are not controlled by any central authority. This decentralization makes them secure and immune to government interference.

When you use cryptocurrency to pay online, the transaction is recorded on a public ledger called the blockchain. This ledger is decentralized and immutable. This means once a transaction is recorded, it cannot be altered. Here’s a simple table explaining the process:

| Step | Description |

|---|---|

| 1 | Choose a cryptocurrency wallet |

| 2 | Transfer funds to your wallet |

| 3 | Select cryptocurrency as payment method at checkout |

| 4 | Complete the transaction using your wallet |

Advantages Of Cryptocurrency

Cryptocurrency payments come with several advantages that make them an attractive option for e-commerce:

- Security: Transactions are highly secure due to cryptographic principles and blockchain technology.

- Speed: Payments are processed quickly, often within minutes, unlike traditional bank transfers.

- Lower Fees: Cryptocurrency transactions generally have lower fees compared to credit card payments.

- Global Reach: Cryptocurrencies can be used globally, without worrying about exchange rates or banking restrictions.

Imagine this: You run an online store. A customer from another country wants to buy your products. With traditional payment methods, they might face high fees or long processing times. But with cryptocurrency, they can pay quickly and securely, and you’ll receive the payment in no time. How convenient is that?

Moreover, cryptocurrencies offer privacy. Users can make transactions without revealing personal information. This is a huge plus for those concerned about online privacy.

In conclusion, cryptocurrency payments are revolutionizing the e-commerce world. They offer secure, fast, and cost-effective transactions. So, why not consider adding this payment method to your online store? It’s a step towards embracing the future of digital transactions.

Two-factor Authentication

Secure online payment methods are crucial for e-commerce businesses. One key element is Two-Factor Authentication (2FA). This adds an extra layer of security to transactions. With 2FA, users must verify their identity in two ways. This helps prevent unauthorized access and fraud. Let’s explore what Two-Factor Authentication is and how to implement it effectively.

What Is Two-factor Authentication?

Two-Factor Authentication, or 2FA, is a security process. It requires two forms of identification. Typically, this includes something you know and something you have. For example, a password and a code sent to your phone. This method ensures that even if someone steals your password, they cannot access your account. It’s an extra barrier against cyber threats.

Implementing Two-factor Authentication

Implementing 2FA in your e-commerce site is simple. First, choose a reliable 2FA provider. Google Authenticator and Authy are popular choices. Next, integrate the 2FA system with your website’s login process. Most 2FA providers offer plugins or APIs for easy integration. Finally, educate your customers about 2FA. Show them how to set it up and why it’s important. This builds trust and enhances security.

Remember to test the 2FA system thoroughly. Ensure it works seamlessly across devices. Monitor the system for any issues. Regular updates and maintenance keep the 2FA system effective. Providing secure online payment methods is essential for customer trust. Two-Factor Authentication is a vital part of that security.

Secure Payment Gateways

Secure payment gateways are essential for safe online transactions. They protect sensitive information. They ensure a smooth shopping experience. Customers feel more confident when they know their data is safe. Let’s explore some top payment gateways and their features.

Top Payment Gateways

Several payment gateways stand out for their security and reliability. PayPal is a popular choice. It offers strong encryption and fraud protection. Stripe is another trusted gateway. It provides advanced security features. Square is also well-known. It ensures secure transactions with robust security measures.

Features Of Secure Gateways

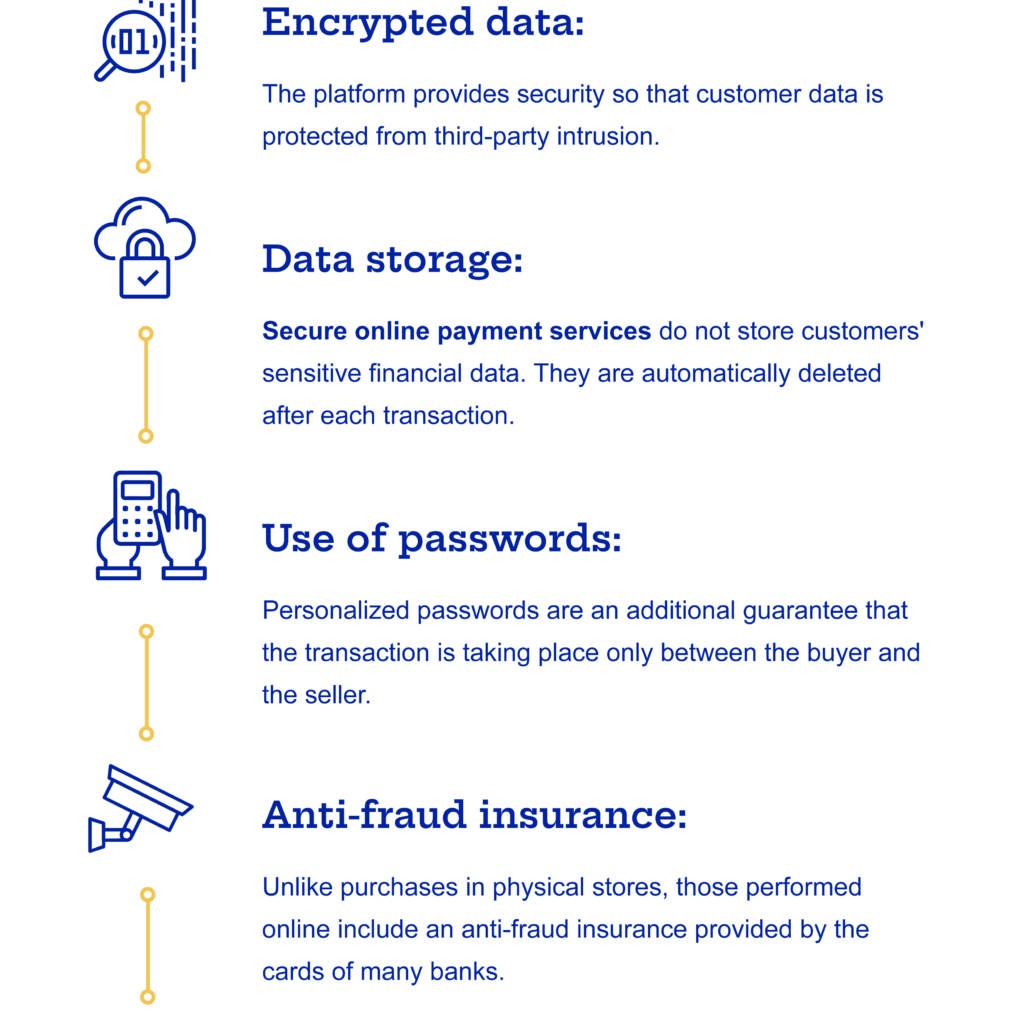

Secure payment gateways have several key features. They use encryption to protect data. This keeps sensitive information safe during transmission. They also offer fraud detection. This helps identify and prevent fraudulent activities. Additionally, they comply with industry standards. PCI DSS compliance is crucial for secure transactions.

Another important feature is tokenization. It replaces sensitive data with unique tokens. This adds an extra layer of security. Secure gateways also offer multi-factor authentication. This ensures only authorized users complete transactions. These features provide a safer online shopping experience.

Fraud Prevention Techniques

In the world of e-commerce, ensuring secure online payment methods is crucial. Fraud prevention is a top priority to protect both your business and your customers. Understanding how to recognize fraudulent activities and the tools available to prevent fraud can make a world of difference. Let’s dive into some effective fraud prevention techniques.

Recognizing Fraudulent Activities

Recognizing fraudulent activities is the first step in preventing them. Here are some common signs to watch out for:

- Unusual Purchase Patterns: Large orders from new customers or multiple transactions in a short period.

- Mismatch Information: Billing and shipping addresses that don’t match or unusual IP addresses.

- High-Risk Countries: Orders from countries known for high fraud rates.

If you notice any of these red flags, it’s essential to take a closer look before processing the order. Ignoring these signs can lead to significant financial losses and damage to your business reputation. So, always be vigilant.

Tools To Prevent Fraud

Thankfully, there are several tools at your disposal to help prevent fraud:

- Address Verification System (AVS): This tool checks if the billing address matches the one on file with the credit card issuer. It’s an effective way to spot discrepancies.

- Card Verification Value (CVV): Requiring the CVV for transactions ensures that the customer physically has the card.

- Two-Factor Authentication (2FA): Adding an extra layer of security by requiring a second form of identification, like a text message code, can prevent unauthorized access.

- Fraud Detection Software: Using AI and machine learning, these tools analyze transaction patterns to detect and flag suspicious activities.

Implementing these tools can significantly reduce the risk of fraud. Think of them as your e-commerce bodyguards, always on the lookout for potential threats.

Fraud prevention might seem daunting, but with the right techniques and tools, you can protect your business and your customers. Stay informed, stay vigilant, and most importantly, stay secure!

Best Practices For Consumers

Shopping online has become very common. It’s easy and convenient. But, it is important to stay safe. Following best practices can help protect your money and information. Here are some tips to help you shop safely online.

Safe Online Shopping Tips

Always shop on websites you trust. Look for the padlock symbol in the address bar. This shows the site is secure. Avoid public Wi-Fi for shopping. Use your home network instead. Check your bank statements often. Report any strange charges right away.

Protecting Personal Information

Do not share your personal details freely. Only provide necessary information. Create strong passwords for your accounts. Use a mix of letters, numbers, and symbols. Change your passwords regularly. Be cautious with emails. Do not click on links from unknown sources. This can prevent phishing scams.

Future Trends In Online Payments

The world of e-commerce is continuously evolving, and with it, the methods we use to make online payments. Innovations in technology are driving these changes, making transactions more secure, faster, and user-friendly. In this section, we’ll explore some of the future trends in online payments that are set to revolutionize the e-commerce landscape. Buckle up, because the future looks both exciting and promising!

Emerging Technologies

Let’s dive into some of the cutting-edge technologies that are shaping the future of online payments:

- Blockchain Technology: Blockchain is not just about cryptocurrencies. Its decentralized nature ensures transparency and security, making it ideal for secure online payments.

- Biometric Authentication: Forget passwords! Fingerprints, facial recognition, and even retina scans are becoming the norm, ensuring payments are both secure and convenient.

- AI and Machine Learning: These technologies are enhancing fraud detection, offering smarter and faster ways to identify and prevent fraudulent transactions.

- Contactless Payments: Near Field Communication (NFC) and RFID technology are making payments as simple as a wave of your hand or tap of your phone.

These technologies are not just futuristic concepts; they are being integrated into our daily lives, making online shopping safer and more enjoyable.

Predictions For E-commerce Payments

What does the future hold for e-commerce payments? Here are some predictions:

- Seamless Cross-Border Transactions: With globalization, the demand for smooth international transactions is higher than ever. Expect more integration and fewer barriers.

- Increased Mobile Payments: As smartphones become more ubiquitous, mobile payments will dominate, offering convenience at our fingertips.

- Personalized Payment Experiences: AI will tailor payment options to individual preferences, making the shopping experience more personalized.

- Enhanced Security Protocols: With the rise of cyber threats, robust security measures will be paramount. Expect multi-layered security approaches.

Imagine a future where you can shop from anywhere in the world, pay with a simple scan of your face, and rest assured that your transaction is secure. That’s the direction we’re heading in!

In conclusion, the future of online payments is bright and brimming with potential. As these trends and technologies continue to develop, they will undoubtedly make our online shopping experiences safer, faster, and more efficient. Stay tuned, because the best is yet to come!

Credit: quintagroup.com

Frequently Asked Questions

What Is The Safest Online Payment Method?

The safest online payment methods are credit cards, PayPal, and Apple Pay. They offer strong fraud protection and encryption.

Which Payment Method Is Best For E-commerce?

Credit and debit cards are the best payment methods for e-commerce. They offer security, convenience, and widespread acceptance.

What Is The Safest Form Of Payment When Selling Online?

The safest form of payment when selling online is through secure platforms like PayPal or credit cards. These methods offer fraud protection and encryption.

What Is The Safest Online Payment App?

PayPal is considered one of the safest online payment apps. It offers robust security features and buyer protection.

Conclusion

Secure online payment methods are crucial for e-commerce success. They build trust. They ensure safety. Customers feel confident. Businesses thrive with secure transactions. Adopting reliable payment methods is essential. It protects both buyers and sellers. Stay updated with the latest security practices.

This helps prevent fraud. Simplify the checkout process. Make it seamless and safe. Prioritize security in your e-commerce strategy. Happy customers return. Safe transactions lead to growth. Keep your online store secure. Your business depends on it.