In the world of online shopping, payment gateways play a crucial role. They ensure secure transactions between buyers and sellers.

Every online store owner needs a reliable payment gateway to thrive. With countless options available, choosing the best one can be overwhelming. Some gateways offer lower fees, while others promise faster processing times. A good payment gateway can significantly impact your business’s success.

It can affect customer trust, sales, and overall growth. We will explore the top payment gateways for online stores. Whether you are new to e-commerce or looking to switch providers, this guide will help you make an informed decision. So, let’s dive in and find the perfect payment gateway for your online store.

Introduction To Payment Gateways

Payment gateways are essential for any online store. They handle transactions between customers and businesses. In this section, we will discuss what payment gateways are and their importance for online stores.

What They Are

Payment gateways are online services. They process credit card payments. They act as intermediaries between a customer and a merchant. Payment gateways ensure secure transactions. They encrypt sensitive information. This protects data from fraudsters.

Importance For Online Stores

Payment gateways offer many benefits. They provide security and convenience. Customers can pay easily and quickly. This increases sales and customer satisfaction. Payment gateways also support various payment methods. This includes credit cards, debit cards, and digital wallets.

Payment gateways also help businesses comply with regulations. They ensure all transactions are secure. This builds trust with customers. Secure transactions are crucial for online stores. They prevent data breaches and financial losses.

Key Features Of Payment Gateways

Choosing the right payment gateway for your online store is crucial. It affects your customer experience and overall business success. Understanding key features of payment gateways can help you make an informed decision.

Security Measures

Payment gateways must prioritize security. They protect sensitive customer data from fraud. Look for gateways with SSL encryption. It ensures secure transactions. Also, consider gateways that are PCI DSS compliant. This certification means they meet industry security standards. Tokenization and encryption are other important security features. They help in safeguarding customer data during transactions.

Transaction Speed

Transaction speed is vital for customer satisfaction. Fast transactions ensure a smooth checkout process. Look for gateways with quick processing times. Some gateways offer instant payment processing. This feature reduces waiting times for customers. Real-time transaction processing can also help in managing cash flow better. It ensures you receive payments promptly.

Top Payment Gateways

Choosing the right payment gateway is crucial for the success of your online store. With numerous options available, it can be overwhelming to decide which one to integrate. In this section, we will delve into some of the top payment gateways that can streamline your transactions and enhance customer experience. Let’s explore two of the most popular options: PayPal and Stripe.

PayPal is a household name in the world of online payments. It’s renowned for its reliability and ease of use. Whether you’re a small business or a large enterprise, PayPal offers solutions tailored to your needs.

- Global Reach: PayPal operates in over 200 countries and supports 25 currencies, making it ideal for international transactions.

- Security: With advanced encryption and anti-fraud measures, PayPal ensures that your transactions are secure.

- User-Friendly: Setting up PayPal is a breeze, and its user interface is intuitive, even for beginners.

Did you know that PayPal also offers features like PayPal Credit for customers and Express Checkout for faster transactions? These can significantly boost your sales and improve customer satisfaction.

Stripe is another top contender in the payment gateway arena. It’s known for its developer-friendly tools and flexibility. Stripe is perfect for businesses that want a customizable payment solution.

- Customizability: Stripe provides extensive APIs that allow you to tailor the payment experience to your specific needs.

- Global Payments: Like PayPal, Stripe supports multiple currencies and operates in numerous countries.

- Advanced Features: Stripe offers features such as recurring billing and subscription management, which are great for businesses with membership models.

Ever heard of Stripe Atlas? It’s a program designed to help you start a global business from anywhere in the world. This can be a game-changer for entrepreneurs looking to expand their reach.

In conclusion, both PayPal and Stripe offer robust solutions for online stores. Your choice will depend on your specific needs and technical capabilities. Whether you prioritize ease of use or customizability, these payment gateways can help you build a trustworthy and efficient online store.

Credit: scandiweb.com

Paypal

When it comes to payment gateways for online stores, PayPal is often the first name that comes to mind. It’s a household name, and for good reason. PayPal has been around since 1998 and has grown to become a trusted payment option for millions of users worldwide. Whether you’re a small business owner or running a large e-commerce site, PayPal offers a range of features that can simplify online transactions and help you reach more customers. Let’s delve into what makes PayPal a top choice for online stores.

Features

PayPal is packed with features that cater to both buyers and sellers. Here’s a quick rundown:

- Ease of Use: PayPal is incredibly user-friendly. Setting up an account is straightforward, and integrating it into your online store is a breeze.

- Security: PayPal uses robust encryption and fraud detection tools to protect users’ financial information.

- Global Reach: PayPal supports over 200 markets and 25 currencies, making it an excellent choice for international transactions.

- Mobile Payments: PayPal’s mobile app allows customers to make payments on the go, catering to the increasing number of mobile shoppers.

- Multiple Payment Options: Accept payments via credit cards, debit cards, and PayPal balance.

- Buyer and Seller Protection: PayPal offers protection policies for both buyers and sellers, giving both parties peace of mind.

Pros And Cons

Like any service, PayPal has its strengths and weaknesses. Let’s explore them:

| Pros | Cons |

|---|---|

|

|

As you can see, PayPal offers a lot of benefits but also has its drawbacks. However, for many online stores, the pros far outweigh the cons. It’s a reliable and secure option that can help you cater to a global customer base, and its ease of use makes it a favorite among both new and established businesses.

So, have you tried using PayPal for your online store? If not, what are you waiting for? Give it a shot and see how it can simplify your payment processes!

Stripe

When it comes to selecting a payment gateway for your online store, Stripe often tops the list. Known for its developer-friendly interface and robust features, Stripe has become a favorite among e-commerce businesses. Whether you’re just starting out or scaling your online store, Stripe offers a versatile solution that can adapt to your needs. Let’s delve into what makes Stripe stand out.

Features

Stripe is packed with features designed to simplify online transactions. Here are some of the standout features:

- Customizable Checkout: Stripe allows you to tailor the checkout experience to match your brand.

- Recurring Billing: Ideal for subscription-based services, Stripe can handle recurring payments effortlessly.

- Fraud Detection: With advanced fraud detection tools, Stripe helps protect your business from fraudulent activities.

- Global Reach: Stripe supports payments in over 135 currencies, making it perfect for international sales.

- Developer Tools: Extensive APIs and documentation make it easy for developers to integrate Stripe into any platform.

Pros And Cons

Like any payment gateway, Stripe has its strengths and weaknesses. Here’s a quick look:

| Pros | Cons |

|---|---|

|

|

Using Stripe can feel like having a Swiss army knife for your online store. But, as with any tool, it’s essential to weigh the pros and cons. Once you get past the initial setup, the benefits far outweigh the drawbacks.

Having used Stripe for my own online store, I can say it’s been a game-changer. The ease of integrating it with my website, coupled with the peace of mind from its robust fraud detection, has made managing payments a breeze. And who doesn’t love a smooth checkout experience?

So, if you’re looking for a payment gateway that offers flexibility, security, and global reach, Stripe might just be the perfect fit for your online store.

Comparing Payment Gateways

Choosing the right payment gateway is crucial for online stores. Different gateways offer various features. Understanding their differences helps you make an informed choice. Let’s compare some key aspects of top payment gateways.

Fees And Costs

Fees can impact your profit margins. Each gateway has its own fee structure. Some charge a flat fee per transaction. Others take a percentage of each sale. For example, PayPal charges a 2.9% fee plus 30 cents per transaction. Stripe has a similar fee structure. It’s important to read the fine print. Some gateways have hidden costs. Always check for additional fees like setup or monthly charges.

Integration Ease

Integration ease affects the user experience. A smooth integration process saves time. Some gateways offer plugins for popular e-commerce platforms. PayPal and Stripe integrate easily with WooCommerce. Square also offers simple integration options. Check if the gateway supports your platform. This ensures a seamless setup. Some gateways require coding knowledge. Others offer no-code solutions. Choose one that matches your technical skills.

Choosing The Right Gateway

Choosing the right payment gateway is crucial for your online store. It impacts customer experience and your business operations. The perfect gateway aligns with your business needs and satisfies customer preferences. Let’s explore how to make the best choice.

Business Needs

Every business has unique needs. Consider the size of your business. Small shops may benefit from low-cost gateways. Large enterprises might need advanced features. Think about transaction volume. High volumes need robust systems. Assess your technical skills. Some gateways are easy to set up. Others require advanced knowledge. Look at the cost structure. Some have flat fees. Others charge per transaction. Choose what fits your budget.

Customer Preferences

Customers have their own preferences. Offer multiple payment options. Credit cards, PayPal, and more. Make it easy for them. Check the gateway’s user interface. It should be simple. Avoid complicated processes. Mobile-friendly gateways are a must. Many shop from their phones. Ensure security. Customers trust secure systems. Look for encryption and fraud protection. A smooth, safe checkout boosts sales.

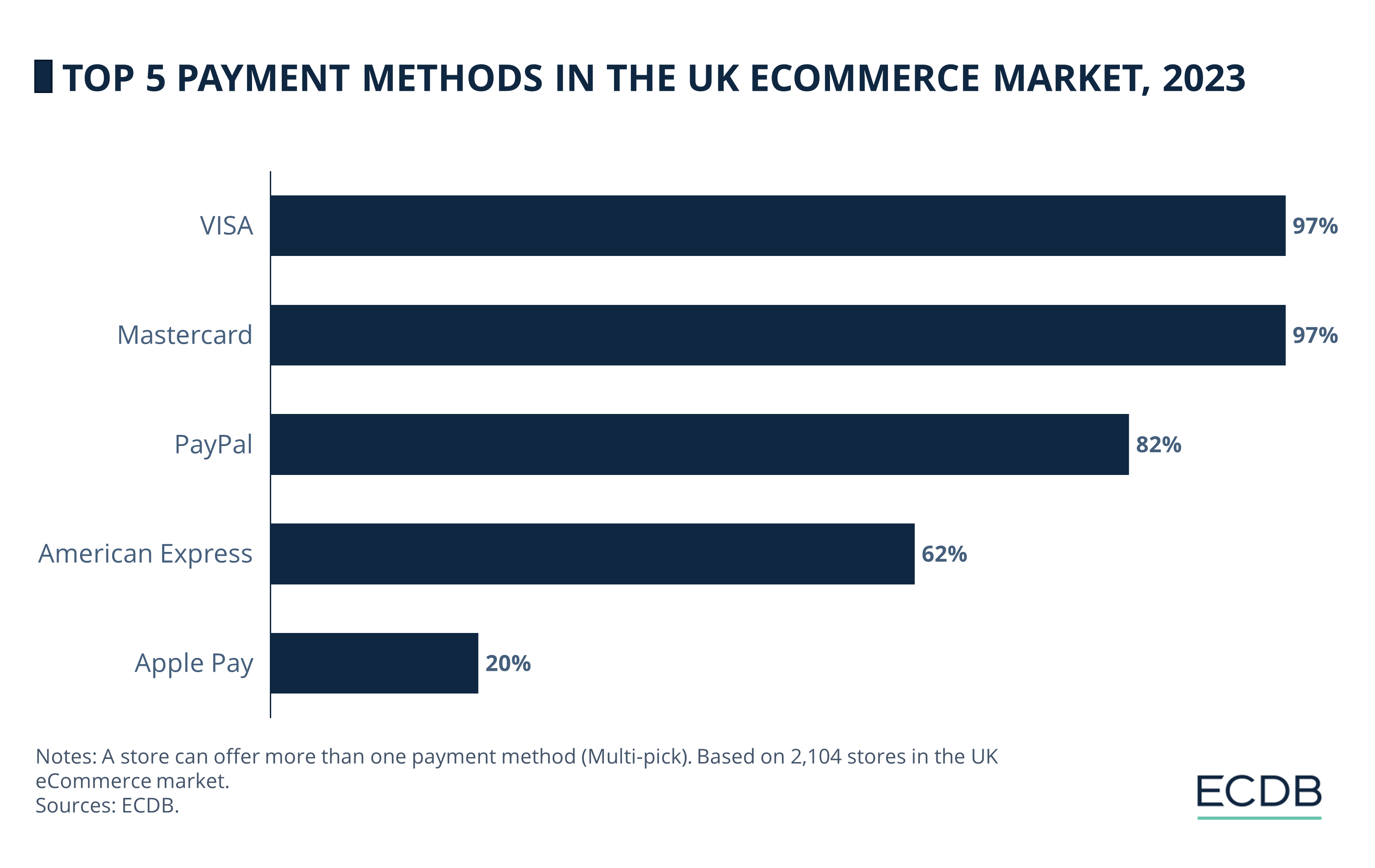

Credit: ecommercedb.com

Future Trends In Payment Gateways

As the e-commerce industry continues to grow, the need for efficient and secure payment gateways becomes increasingly important. Understanding future trends in payment gateways can help online store owners stay ahead of the curve, offering their customers the best possible payment experience. Let’s dive into some of the most exciting trends and market predictions shaping the future of payment gateways.

Emerging Technologies

Technology is evolving at a breakneck speed, and payment gateways are no exception. Here are some key technologies that are set to revolutionize the way we handle online payments:

- Blockchain Technology: Blockchain offers a decentralized and secure way to process transactions. It’s particularly beneficial for cross-border payments, reducing costs and increasing transparency.

- Biometric Authentication: Say goodbye to passwords. With biometric authentication, users can verify payments using their fingerprints, facial recognition, or even voice recognition. It’s fast, secure, and user-friendly.

- Artificial Intelligence: AI can detect fraudulent transactions in real-time, reducing the risk of fraud. It can also provide personalized payment experiences based on user behavior.

Market Predictions

What does the future hold for payment gateways? Here are some market predictions to keep an eye on:

- Increased Adoption of Mobile Payments: Mobile payment solutions like Apple Pay, Google Wallet, and Samsung Pay are becoming more popular. By 2025, it’s expected that mobile payments will account for a significant portion of online transactions.

- Growth in Digital Currencies: Cryptocurrencies like Bitcoin and Ethereum are gaining acceptance as legitimate forms of payment. More businesses will start accepting digital currencies, providing customers with more options.

- Enhanced Customer Experience: Payment gateways will focus on improving the overall customer experience. This includes faster transaction times, seamless integrations with various platforms, and better customer support.

As an online store owner, staying informed about these future trends can help you make strategic decisions that will benefit your business. Embrace emerging technologies and keep an eye on market predictions to stay ahead in the competitive e-commerce landscape.

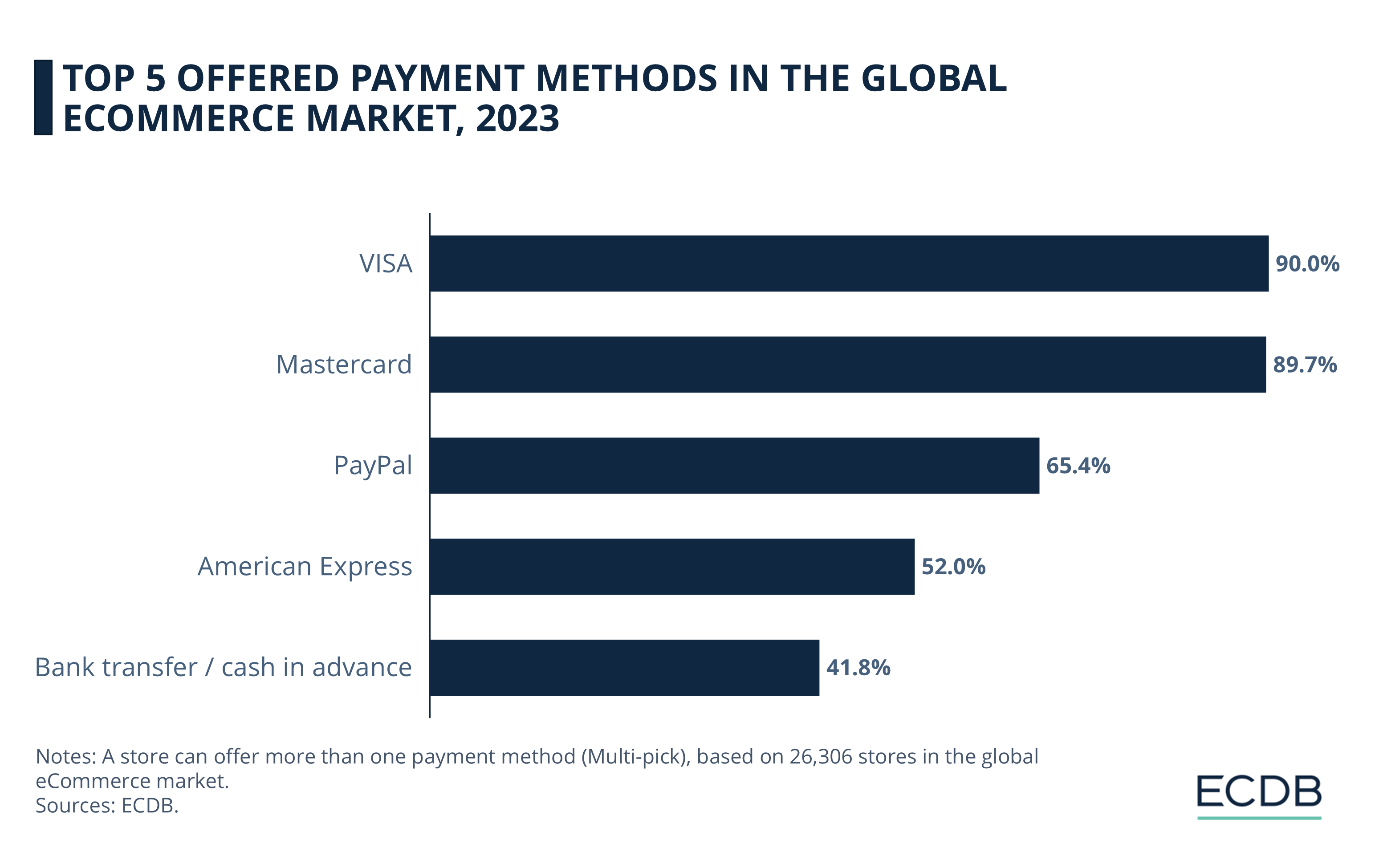

Credit: ecommercedb.com

Frequently Asked Questions

What Is The Most Popular Online Payment Gateway?

PayPal is the most popular online payment gateway. It offers secure transactions and is widely accepted by online merchants globally.

Which Payment Method Is Best For Online Business?

Credit cards and PayPal are the best payment methods for online business due to their security and popularity.

What Are The 5 Types Of Payment Gateways For E Commerce?

The 5 types of payment gateways for e-commerce are: 1. Hosted payment gateways. 2. Self-hosted payment gateways. 3. API hosted payment gateways. 4. Local bank integration gateways. 5. Mobile payment gateways.

What Is The Best Payment Gateway For E Commerce?

The best payment gateway for e-commerce depends on your needs. Popular options include PayPal, Stripe, and Square for their reliability and features.

Conclusion

Choosing the right payment gateway is crucial for your online store. It impacts customer trust and satisfaction. Consider your store’s needs and customer preferences. Compare fees, features, and security. A well-chosen gateway can boost sales and streamline transactions. Make an informed decision to ensure smooth, secure payments.

Happy selling!